Contribution Limits For 2024

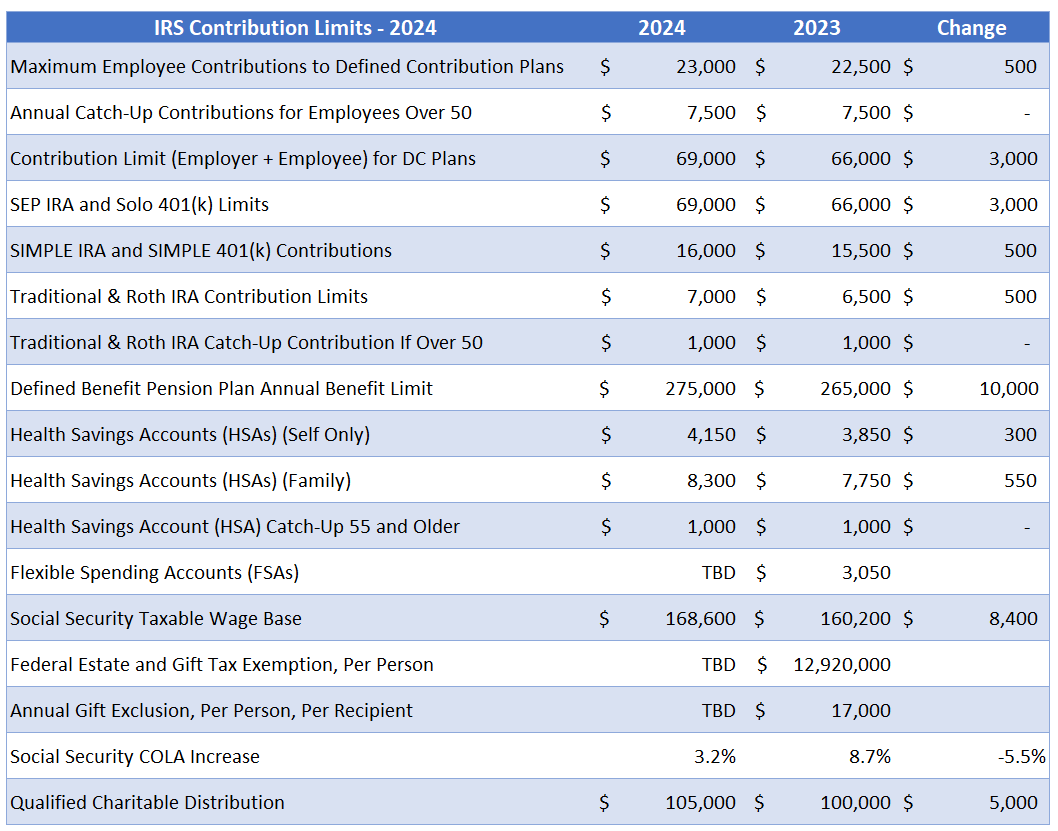

Contribution Limits For 2024 – The parameters of this government largesse change annually. For 2024, the IRS only allows you to save a total of $7,000 across all your traditional and Roth IRAs, combined. This figure is up from the . Participating in a 401(k) through your employer can be a good way to contribute to and save for your retirement. One important thing to know is that there are limits on how much you can contribute .

Contribution Limits For 2024

Source : www.advantaira.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comHere’s the Latest 401k, IRA and Other Contribution Limits for 2024

Source : theneighborhoodfinanceguy.comIRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.com2024 401(k) and IRA contribution limits announced! – Personal

Source : www.personalfinanceclub.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comIRS Announces 2024 Increases to FSA Contribution Limits | SEHP

Source : sehp.healthbenefitsprogram.ks.govThe IRS Has Increased Contribution Limits for 2024 — Human Investing

Source : www.humaninvesting.com2024 IRS 401k IRA Contribution Limits | Darrow Wealth Management

Source : darrowwealthmanagement.comIRS Makes Historical Increase to 2024 HSA Contribution Limits

Source : www.firstdollar.comContribution Limits For 2024 2024 Contribution Limits Announced by the IRS: Find out everything you need to know about 2024 tax brackets, from how they work to how they’ve changed and how they impact your tax liability. . If you’ve been wishing you could squirrel away more money for retirement, you’re in luck – contribution limits are heading upwards starting in 2024. Aileen Cannon Gives Donald Trump a 48 Hour Deadline .

]]>